I can’t help smiling when I think of the number of times, I hear people in the US who genuinely seem to believe that practices for best sports betting are way riskier than stock market investing.

Before, discussing this further, I think it is worth pointing out that the author has spent a lifetime involved in industries ranging from accounting & corporate finance to small start-ups and large public companies. This includes investing in stocks, commodities, cryptocurrencies and various other instruments such as options and hedges. He has held many high finance positions such as CFO of Banks, and CEO of Publicly listed Tech businesses. He has lectured in Business Finance to an esteemed corporate executive master’s class at a leading University. So, the opinions expressed here do not come from a position of ignorance or inexperience. Like all opinions, you can decide for yourself if you agree with them.

Similarities between sports betting and stock market investing

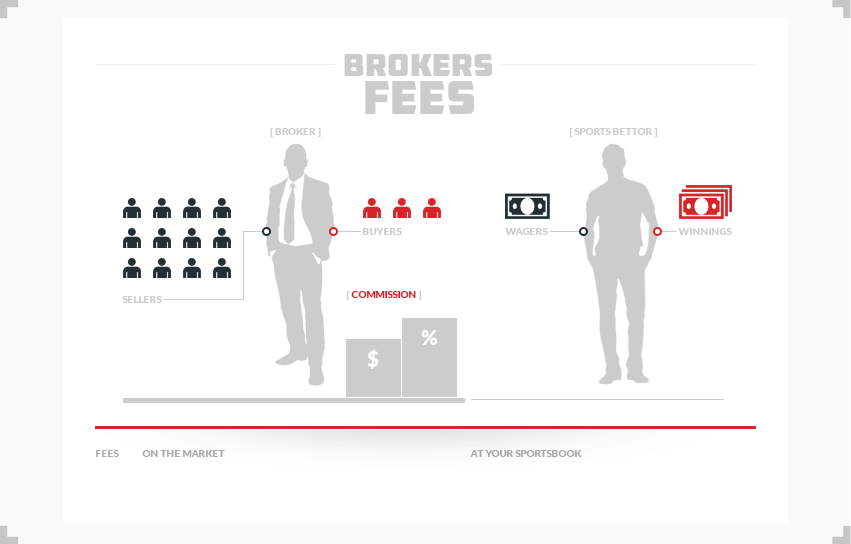

There are huge similarities between best sports betting concepts and the more general stock markets. They both basically operate as a form of ‘efficient market’. Here the ‘investor’/gambler must use their own knowledge or intuition to gain an edge. This is not easy and there are many barriers against doing better than the market, especially if you believe that the assets (or sports betting lines) are already fairly priced. This is exactly what the markets try to achieve.

Some of the reasons that especially US citizens believe that stock markets are a better form of investing include-

- The market is full of well know businesses and potential high-growth ones. If you pick the right ones, you can gain big over the long term. these could even include the best betting site in USA.

- The new exciting world of cryptocurrencies and other high-risk markets such as commodities (as well as stocks) contain so much data analysis that can give you ‘an edge’ (e.g. fundamental and technical analysis)

- Somehow the world of sports betting is ‘murkier’ than the high-brow world of corporate boardrooms. Best sports betting practices are somehow inferior.

Here are my thoughts on the above,

(from 40 years of experience)

Market Statistics for Public Companies are very misleading.

- As a general rule, all of the failures are not in the statistics. Market measurements tend to focus on the surviving businesses and their growth. So, Google might have grown by let’s say 100% per annum, which sounds very attractive. However, an investor in 10 high-tech companies in the dot.com era would have lost 100% of his investment in at least 9 of these businesses. Using simple averages, if he was lucky enough to invest in Google out of these 10, his real returns would be more like 10% per annum. They would not be the 100% the stock market statistics would have you believe. The bottom line is over the long term, the stock markets are much riskier than you are led to believe

Stock market analysis techniques

- There are great bodies of educational material on stock market analysis techniques, as all business students know. However, the conclusion is that they are generally ineffective. This is for the simple and obvious reason that everybody is using the same techniques. In the pre-algo days, some level of statistical analysis edge was feasible. However, for the most part, those days are long gone. As ‘moneyball’ and ‘algo betting’ trends show, the exact same arguments apply for and against sports betting and analysis. On balance, there is no real difference between the two worlds in this regard. If one were biased, you could argue more strongly that more upside here exists for best sports betting potential, given the market is less mature.

Organized crime

- This probably has something to do with the long-ingrained view in the American consciousness that somehow the world of sports betting integrates with the world of ‘mafia’ and organized crime. Unfortunately, for those holding onto such views, they are 50 years out of date. The world of sports betting is almost 100% controlled by large Public Companies. These have the exact same standards as any other large stock market business. From personal experience and knowledge of the people that inhabit both worlds, there is very little difference whatsoever in the standards and degree of trust that exist in these worlds. For every ‘Sports-book executive’ making a greedy decision, not in the interests of his clients, I can assure you there are 10 charlatan decision-makers operating out of Wall Street and 100 other ‘regular business’ executives across corporate America acting purely in their own self-interest, no matter what they profess publicly.

Summary

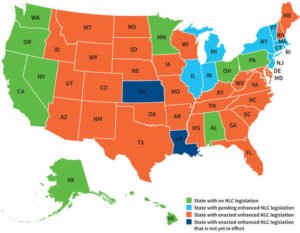

So, in conclusion, the world of sports betting is not inferior or riskier than the world of stock market investing. It is not less professionally run nor less trustworthy. In fact, they are equal in these regards, with all the good and bad on both sides that entails. As Americans become more mature in best sports betting. I expect that these biases will finally erode. However, this might take 5 to 20 years given how immature the current market is.